I’ve got three items this week, responding to readers’ thoughts and questions.

First is a follow-up to last week’s column about how recent Cuyahoga County property assessments created big, unvoted tax hikes for most people. I argued for city and county governments to roll back a tax rate to return the entirety of that increase. I said we knew of none doing that.

I heard from a council member in one suburb who said he and his colleagues in a few other West Side towns are, indeed, exploring tax relief. Unfortunately, he’s aiming it only at the elderly and the needy. He seeks a loophole in Ohio law to maintain the increase from businesses, as well as middle- and upper-class homeowners.

Nice try, but wrong. I don’t think a loophole exists, but the aim violates the basic principles of Ohio property taxes.

Like it or not, in this state, voters control property taxes. Governments that need cash must make their case and persuade voters to approve them. Because those taxes cannot rise with inflation, every few years the governments need more money and ask us again. Usually, voters approve.

The system puts a citizen check on governments. We reject taxes if they waste money. Also, be aware, with the cities, most of their budgets come from income taxes, which rise with wages, giving them built-in inflation protection.

I offer all this to explain why suburbs looking to roll back the big tax increase err by limiting it to elderly and needy homeowners. Give it all back. Or face ire when you next ask for a tax increase. The readers I heard from are furious about the unvoted tax increase and glad our newsroom is speaking up for them.

Topic two: Readers have asked about a disclosure on some stories that they were written with the assistance of artificial intelligence.

We’re experimenting to determine whether AI might help us generate stories about areas we don’t cover, mainly the region’s many municipalities. We collect news releases about items that some might find interesting and use AI to convert them into stories in our writing style. A reporter is at the keyboard throughout the process, reading and editing the results. Nothing gets published without a reporter’s hand on it.

So far, the results are mixed. Some stories, such as those about things to do, are widely read. Others, not so much. The next phase of the experiment will be using AI to analyze what goes on in government meetings, in search of hot topics that our reporters might explore.

Our policy on AI disclosure is simple. If AI produces any text in a story we publish, no matter how short, we’ll attach a note. But if we use AI for basic reporting such as data analysis – the same way we use Microsoft Excel, for example – then I see no need to disclose that. Reporters use many tools, but the reporters do the analyzing.

I’m excited about AI because I believe it will relieve reporters of tedious duties, freeing them to pursue meatier topics.

Lastly, I wrote a few weeks ago about bringing another puppy home, a year after we lost Ella, our golden retriever. A bunch of you asked me what the puppy’s name is, and as always with me, the answer is a story.

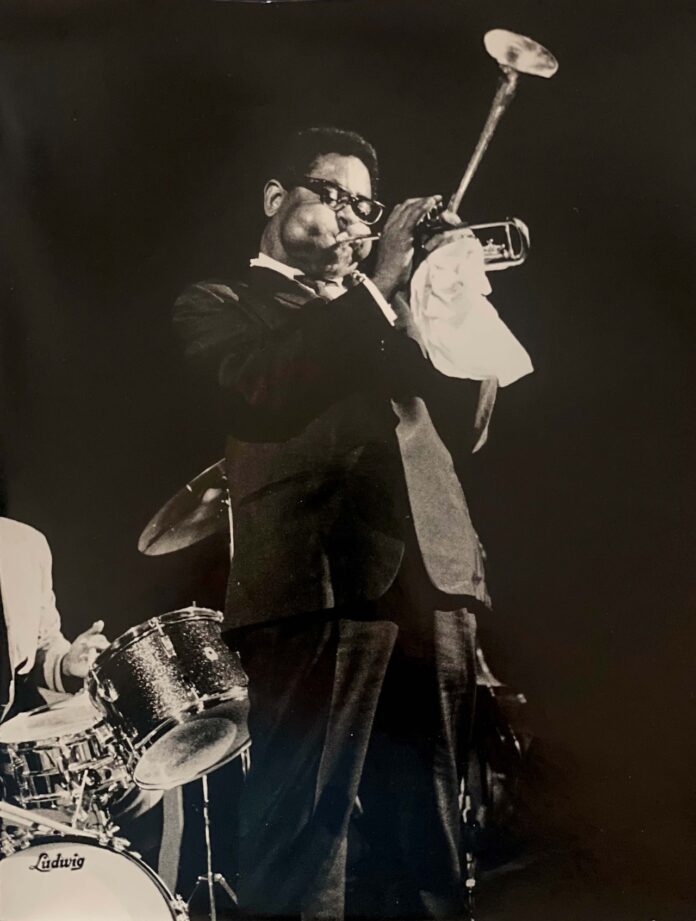

Our previous three goldens were named Hoagy, Satchmo and Ella, for Hoagy Carmichael, Louis Armstrong and Ella Fitzgerald. Some years ago, we decided to name the next for Dizzy Gillespie. If you’ve spent time with golden retrievers, you might agree Dizzy is the perfect name. Our daughter thought so, anyway, and immediately tried to lay claim to the idea, resulting in years of good-natured debate at holiday gatherings.

As we discussed getting a puppy earlier this year, however, my wife and I vacillated. Can Dizzy be a girl’s name? What about Etta – a close relative of the name Ella – for Etta James? Or Billie, for Billie Holiday?

Then the universe knocked.

Lisa Garvin is a community member of our newsroom Editorial Board and a panelist on our weekday Today in Ohio podcast, where we dissect the news of the day. Her late dad, Dr. Harry C. Garvin, was an avid jazz fan, spending a lot of time with his wife, Doris, in Cleveland and New York jazz clubs in the 1950s, ‘60s and ‘70s. He also was an avid photographer, taking photos of many jazz greats. Lisa said her house had a darkroom where her dad did all his work, and the home is full of framed images of such giants as Miles Davis and Duke Ellington.

One day earlier this summer, before I had mentioned to anyone that we might get another dog, Lisa, knowing I love jazz, offered me one of her dad’s prints.

Dizzy Gillespie. It’s the photo at the top of this column.

When I brought it home and showed my wife Kathy, we agreed the debate was over. When the universe knocks, you answer the door. Lisa’s mom, who owns the rights to the photo, gave me permission to use it here. And she told me she, too, likes the name Dizzy.

Jazz fans might appreciate that for years to come, with any luck, two words will ring out regularly in our home.

“Hey Diz!”

I’m at [email protected]

Thanks for reading